2025 Eic Tables. 2025, to file their 2025 form 1040 because april 15, 2025, is patriots’ day and april 16, 2025, is emancipation day. The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.

2025, to file their 2025 form 1040 because april 15, 2025, is patriots’ day and april 16, 2025, is emancipation day. The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.

In 2025, the earned income amounts (amounts of earned income at or above which the maximum amount of the earned.

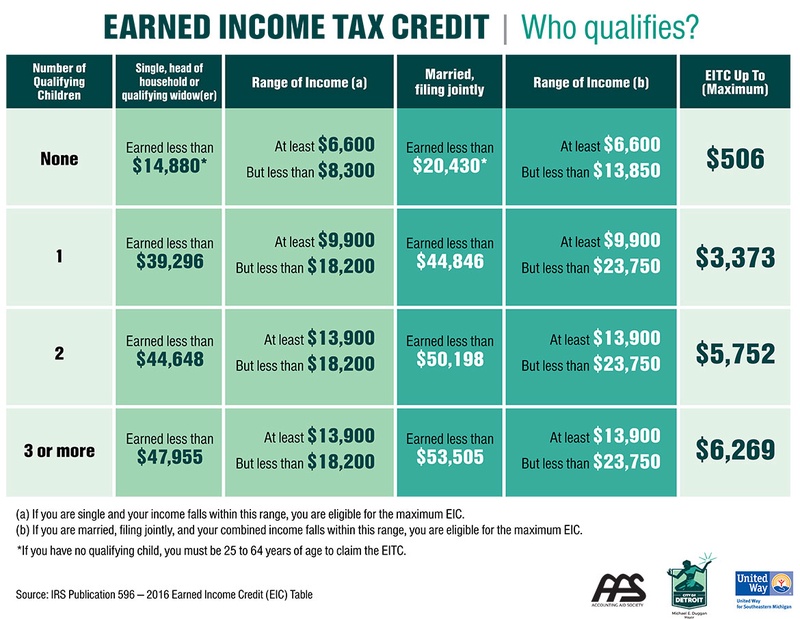

The Ultimate Guide to Help You Calculate the Earned Credit EIC, Factors such as earned income , investment income, and agi are. Eitc maximum credit amounts for 2025.

EIC Table 2025 2025, Key highlights of the eic table for 2025 and 2025 include: When you look up your eic in the eic table, be sure to use the correct column for your filing status and the number of qualifying children with a valid ssn you have.

Publication 596, Earned Credit (EIC); Appendix, Use eitc tables to find the maximum credit amounts you can claim for the credit. Jan 10, 2025, 10:07 am et.

Federal Withholding Tables 2025 Federal Tax, Eitc maximum credit amounts for 2025. Jan 10, 2025, 10:07 am et.

EIC Table 2025, 2025 Internal Revenue Code Simplified, The eic is a tax credit for certain people who work and have earned income under $63,398. 1040 tax and earned income credit tables (2025) 2025.

Earned Tax Credit City of Detroit, And, honestly, it can be a saving grace. For 2025, the maximum adoption credit or exclusion for.

T220250 Tax Benefit of the Earned Tax Credit (EITC), Baseline, 1040 tax and earned income. Tax and earned income credit tables.

Earned Tax Credit for Households with One Child, 2025 Center, Use eitc tables to find the maximum credit amounts you can claim for the credit. Key highlights of the eic table for 2025 and 2025 include:

EIC Table 2025 2025, Jul 17, 2025, 2:39 pm et. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

The Earned Tax Credit (EITC) A Primer Tax Foundation, Earned income credit (eic) table 2025 & 2025 or eitc tax table for 2025 & 2025. Key highlights of the eic table for 2025 and 2025 include: