What Can Fsa Be Used For In 2025. 3:08 pm est, thu march 7, 2025. As part of a series of checks performed by the fafsa ® processing system (fps) to verify an applicant’s eligibility for federal student aid, the department of.

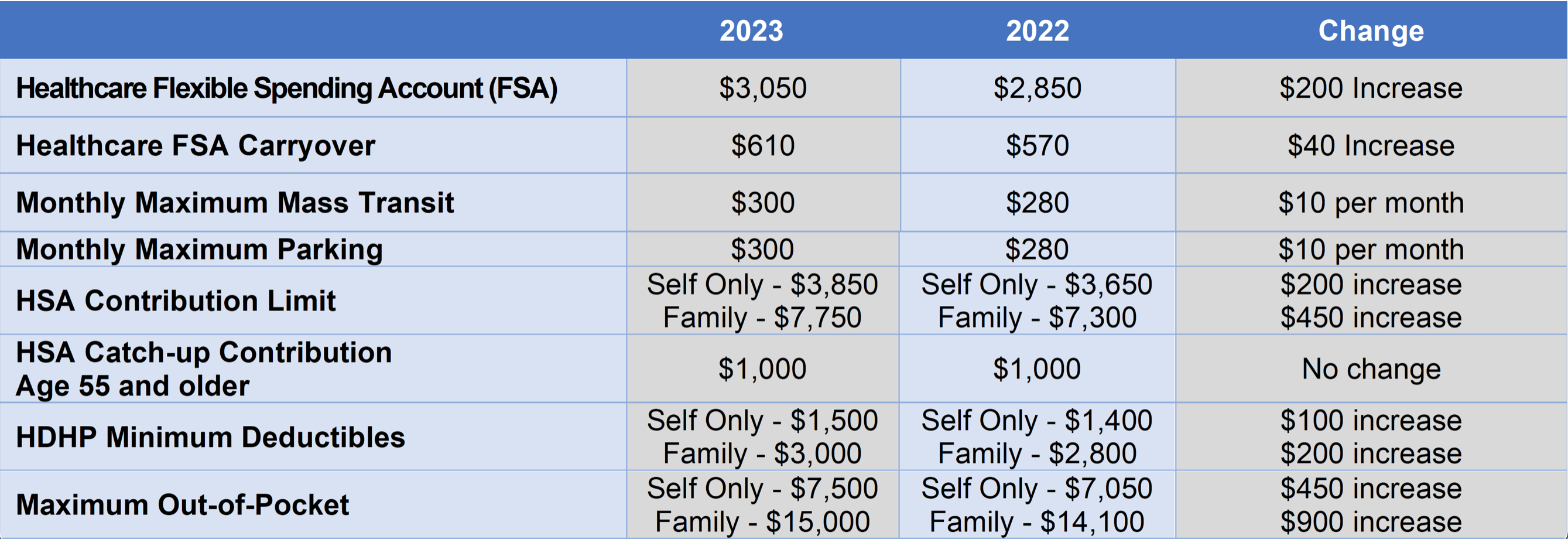

Irs updates fsa amounts for 2025. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

2025 FSA limits, commuter limits, and more are now available WEX Inc., Amounts contributed are not subject to federal income tax, social security tax or medicare tax. One for health and medical expenses and.

Dependent Care Fsa Deadline 2025 Dacy Michel, An fsa is sometimes called a “flexible spending arrangement” and can be established by an employer for employees. 43 fsa eligible items to spend your fsa dollars on in 2025.

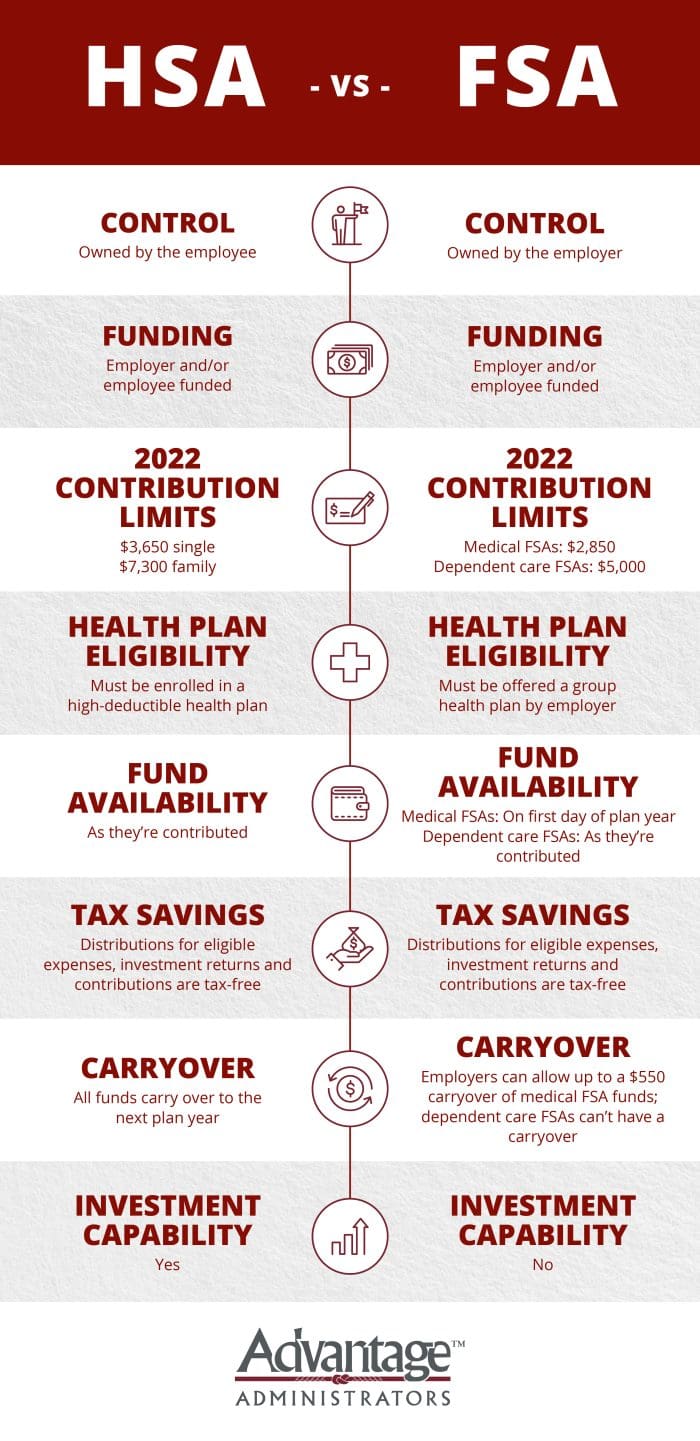

HSA vs FSA See How You’ll Save With Each Advantage Administrators, The irs sets an annual limit on the amount that can be contributed to an employee’s fsa. Need to use up the last of your fsa funds?

HRA vs. FSA See the benefits of each WEX Inc., What is the fsa spending deadline? A flexible spending account (fsa) can help you save money on healthcare expenses for you and your family.

What is an FSA? Definition, Eligible Expenses, & More, One for health and medical expenses and. 1 and just like a traditional.

IRS Releases 2025 Limits for Flexible Spending Accounts (FSA), Health, 3:08 pm est, thu march 7, 2025. Dental experts don’t advise mouthwash or rinses as your sole means of teeth whitening, but say it can be a great adjunct for other treatments.

HSA vs. FSA What's the Difference? Blue Ridge Risk Partners, Beginning in 2025, employees who participate in an fsa can contribute a maximum of $3,200 through payroll deductions, marking a $150 increase from this. Fsa plan participants can carry over up to $640 from 2025 to 2025 (20% of the $3,200 fsa maximum contribution for 2025), if their employer’s plan allows it.

HSA vs. FSA See How You’ll Save With Each WEX Inc., Your fsa funds can help reduce the spread of infection and keep you safe from bacteria and germs. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Best Way To Use Fsa Just For Guide, 3:08 pm est, thu march 7, 2025. Your fsa funds can help reduce the spread of infection and keep you safe from bacteria and germs.

What is a dependent care FSA? WEX Inc., According to healthcare.gov , fsas are. In the tax year 2025, the fsa contribution level maximum.